Are Finance Apps Making You Smarter or Just Addicted? Are Finance Apps Making You Smarter or Just Addicted?

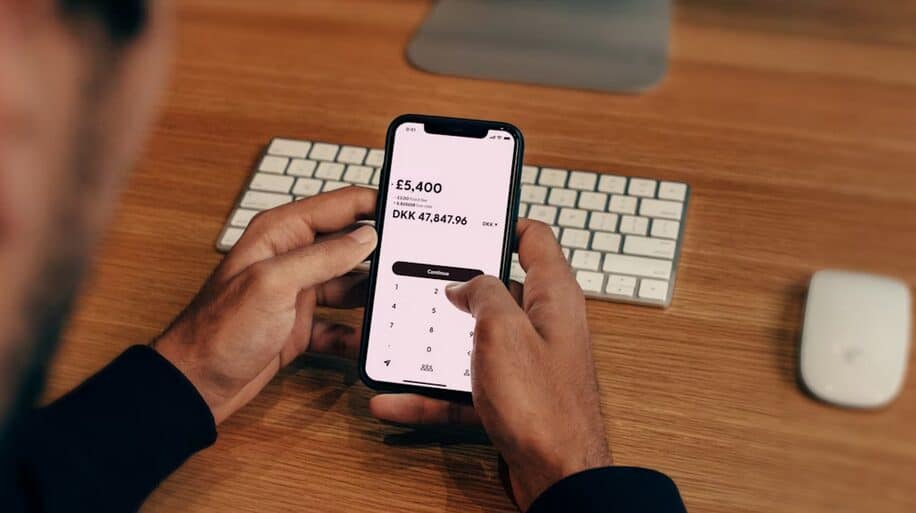

There’s no denying it—finance apps have revolutionized the way we manage money. From budgeting and investing to tracking spending and credit scores, these tools put financial control right in the palm of our hands. But with easy access comes a question worth asking: are these apps really helping us become smarter with money, or are they just creating a new kind of addiction?

As more people download multiple finance apps, obsess over their stock portfolios, or compulsively check their credit scores, it’s worth taking a step back to understand how these tools impact our behavior—and our brains.

The Power of Instant Feedback

One of the biggest benefits of finance apps is immediate feedback. When you make a purchase or invest, you get real-time updates on your account balance or portfolio value. This can be incredibly motivating. Seeing your savings grow or watching your spending habits improve creates a sense of achievement. Instant feedback is a powerful learning tool, helping users build better money habits over time.

Gamification Keeps You Engaged

Many finance apps use gamification—think badges, progress bars, or rewards—to keep users coming back. This design taps into our natural desire for achievement and competition. On the positive side, gamification can make managing money feel less like a chore and more like a game. But the flip side is that it can encourage obsessive checking or compulsive behavior, turning a healthy habit into a constant need for validation.

Does More Data Mean Smarter Decisions?

Finance apps give you access to a wealth of data about your spending, savings, and investments. But having more data doesn’t always mean you’re making better choices. Sometimes, users can get overwhelmed or misinterpret information without proper context. Without financial education, it’s easy to jump to conclusions or make impulsive moves based on short-term numbers instead of long-term goals.

The Danger of Over-Checking

How many times have you found yourself refreshing your investment app or checking your budget tracker “just to be sure”? The line between staying informed and compulsive behavior can be blurry. Over-checking can increase anxiety and lead to poor decisions driven by emotional reactions instead of rational planning. Finance apps can unintentionally promote this hyper-vigilance, especially when markets fluctuate or bills pile up.

Privacy Concerns and Mental Stress

Handing over your financial data to apps comes with privacy risks. Knowing that your sensitive info is stored on multiple platforms can cause unease. Additionally, constantly monitoring your money—especially if things aren’t going great—can create mental stress. What started as a tool to ease financial worries might end up adding a layer of anxiety instead.

Empowerment Through Education

On the brighter side, many finance apps are now focusing on financial education. They offer tips, tutorials, and personalized advice to help users understand concepts like investing, debt management, and saving strategies. When combined with the right mindset, these tools can genuinely boost financial literacy and confidence, turning users into smarter money managers.

Balance Is Key

Like most things in life, the key is balance. Finance apps are powerful tools that can boost your money knowledge and control—if you use them wisely. It’s important to set boundaries around app usage, avoid obsessive checking, and complement technology with real-world education and planning. Remember, an app is a tool, not a magic solution.

Finance apps come with incredible potential to make managing money easier and more engaging. They offer instant insights, personalized advice, and motivation that were unthinkable a few decades ago. But they also carry the risk of encouraging addictive behaviors, anxiety, and poor decision-making if not used mindfully.…

CarsDirect has been one of the most popular places to get a

CarsDirect has been one of the most popular places to get a

Analytics can help you grow your business in several ways. First, it can help you track your website traffic and see where your visitors are coming from. This information is crucial because it can help you adjust your marketing efforts to target the right audience. Second, analytics can help you track your conversion rates and see which products or pages convert the most visitors into customers. This information is crucial because it can help you focus your efforts on the areas yielding the most results. Finally, analytics can help you track your customer service data and see which issues are causing the most problems for your customers.

Analytics can help you grow your business in several ways. First, it can help you track your website traffic and see where your visitors are coming from. This information is crucial because it can help you adjust your marketing efforts to target the right audience. Second, analytics can help you track your conversion rates and see which products or pages convert the most visitors into customers. This information is crucial because it can help you focus your efforts on the areas yielding the most results. Finally, analytics can help you track your customer service data and see which issues are causing the most problems for your customers. Analytics can help you grow your business and find areas of improvement, but it can also help you understand which products or services are most popular with your customers. This information is crucial because it can help you focus your marketing efforts on the right products and ensure that you are stocking the items your customers want. Additionally, this information can help you identify any new products or services that your customers may be interested in so that you can add them to your store.

Analytics can help you grow your business and find areas of improvement, but it can also help you understand which products or services are most popular with your customers. This information is crucial because it can help you focus your marketing efforts on the right products and ensure that you are stocking the items your customers want. Additionally, this information can help you identify any new products or services that your customers may be interested in so that you can add them to your store.

When trying to build your credit up, a Las Vegas Credit Repair Company can be of great help as well. They will work with you and provide suggestions that could improve your score in no time at all. Many people who are not familiar with this process don’t know what they should do to build their credit back up.

When trying to build your credit up, a Las Vegas Credit Repair Company can be of great help as well. They will work with you and provide suggestions that could improve your score in no time at all. Many people who are not familiar with this process don’t know what they should do to build their credit back up. One of the main reasons people hire a credit repair company is because they don’t have time to deal with their creditors. When you hire a professional, they will take care of all your communications. They will also work out payment plans and settlements so that your debt does not continue to increase.

One of the main reasons people hire a credit repair company is because they don’t have time to deal with their creditors. When you hire a professional, they will take care of all your communications. They will also work out payment plans and settlements so that your debt does not continue to increase. If you are in foreclosure or bankruptcy, don’t do this by yourself. It is a highly complex process, and hiring a professional can help make things go much smoother for you. A Las Vegas credit repair company has the experience dealing with these types of cases to ensure they get their clients through them successfully. They will handle all the paperwork and negotiations on your behalf, so you don’t have to.

If you are in foreclosure or bankruptcy, don’t do this by yourself. It is a highly complex process, and hiring a professional can help make things go much smoother for you. A Las Vegas credit repair company has the experience dealing with these types of cases to ensure they get their clients through them successfully. They will handle all the paperwork and negotiations on your behalf, so you don’t have to.

One of the main benefits of having a car insurance plan is that it provides a personal accident cover for a pre-determined amount. In other words, it is crucial to understand that a personal accident cover offers protection against death due to an accident or permanent total disability.

One of the main benefits of having a car insurance plan is that it provides a personal accident cover for a pre-determined amount. In other words, it is crucial to understand that a personal accident cover offers protection against death due to an accident or permanent total disability. It is crucial to understand that you will get an online offer in most insurance policies to benefit from no claim bonus. It is a discount on premium provided by most insurance companies. It acts as a reward for the prudent use of cars. Understanding how it works will help you determine how much you can save on your next car insurance renewal.

It is crucial to understand that you will get an online offer in most insurance policies to benefit from no claim bonus. It is a discount on premium provided by most insurance companies. It acts as a reward for the prudent use of cars. Understanding how it works will help you determine how much you can save on your next car insurance renewal.

the conventional type. You can also access them with a poor credit score because of the different factors they will consider to tell if you are eligible. Choosing the right moneylender is essential if you want to have a smooth time during the borrowing and repayment process. Here is what to consider when looking for a moneylender.

the conventional type. You can also access them with a poor credit score because of the different factors they will consider to tell if you are eligible. Choosing the right moneylender is essential if you want to have a smooth time during the borrowing and repayment process. Here is what to consider when looking for a moneylender. had the chance to borrow from these platforms will help you know the best moneylender. There are different platforms where you will come across comments from different people who have had the chance of borrowing from various lenders. This will help you understand how most of them work and also the reputation of specific lenders out there.…

had the chance to borrow from these platforms will help you know the best moneylender. There are different platforms where you will come across comments from different people who have had the chance of borrowing from various lenders. This will help you understand how most of them work and also the reputation of specific lenders out there.…

There are some of the payroll systems that tend to be complicated. Most of your employees may find it challenging operating some of the tools involved. But once you have hired a qualified payroll company, they will be in a good position of running most of these devices.

There are some of the payroll systems that tend to be complicated. Most of your employees may find it challenging operating some of the tools involved. But once you have hired a qualified payroll company, they will be in a good position of running most of these devices. It is clear that many companies out there have existing business investments for various benefits. That is why when you are choosing the right company you need to check on the data integration capabilities. Some of the benefits you are recommended to get are: reduced paperwork, point-in-time reporting and eliminated duplicate data entry.

It is clear that many companies out there have existing business investments for various benefits. That is why when you are choosing the right company you need to check on the data integration capabilities. Some of the benefits you are recommended to get are: reduced paperwork, point-in-time reporting and eliminated duplicate data entry.