Are Finance Apps Making You Smarter or Just Addicted? Are Finance Apps Making You Smarter or Just Addicted?

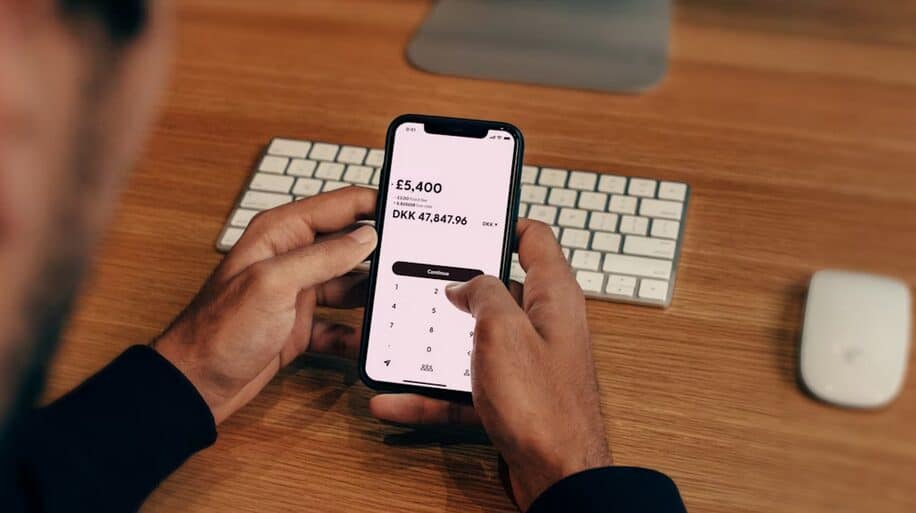

There’s no denying it—finance apps have revolutionized the way we manage money. From budgeting and investing to tracking spending and credit scores, these tools put financial control right in the palm of our hands. But with easy access comes a question worth asking: are these apps really helping us become smarter with money, or are they just creating a new kind of addiction?

As more people download multiple finance apps, obsess over their stock portfolios, or compulsively check their credit scores, it’s worth taking a step back to understand how these tools impact our behavior—and our brains.

The Power of Instant Feedback

One of the biggest benefits of finance apps is immediate feedback. When you make a purchase or invest, you get real-time updates on your account balance or portfolio value. This can be incredibly motivating. Seeing your savings grow or watching your spending habits improve creates a sense of achievement. Instant feedback is a powerful learning tool, helping users build better money habits over time.

Gamification Keeps You Engaged

Many finance apps use gamification—think badges, progress bars, or rewards—to keep users coming back. This design taps into our natural desire for achievement and competition. On the positive side, gamification can make managing money feel less like a chore and more like a game. But the flip side is that it can encourage obsessive checking or compulsive behavior, turning a healthy habit into a constant need for validation.

Does More Data Mean Smarter Decisions?

Finance apps give you access to a wealth of data about your spending, savings, and investments. But having more data doesn’t always mean you’re making better choices. Sometimes, users can get overwhelmed or misinterpret information without proper context. Without financial education, it’s easy to jump to conclusions or make impulsive moves based on short-term numbers instead of long-term goals.

The Danger of Over-Checking

How many times have you found yourself refreshing your investment app or checking your budget tracker “just to be sure”? The line between staying informed and compulsive behavior can be blurry. Over-checking can increase anxiety and lead to poor decisions driven by emotional reactions instead of rational planning. Finance apps can unintentionally promote this hyper-vigilance, especially when markets fluctuate or bills pile up.

Privacy Concerns and Mental Stress

Handing over your financial data to apps comes with privacy risks. Knowing that your sensitive info is stored on multiple platforms can cause unease. Additionally, constantly monitoring your money—especially if things aren’t going great—can create mental stress. What started as a tool to ease financial worries might end up adding a layer of anxiety instead.

Empowerment Through Education

On the brighter side, many finance apps are now focusing on financial education. They offer tips, tutorials, and personalized advice to help users understand concepts like investing, debt management, and saving strategies. When combined with the right mindset, these tools can genuinely boost financial literacy and confidence, turning users into smarter money managers.

Balance Is Key

Like most things in life, the key is balance. Finance apps are powerful tools that can boost your money knowledge and control—if you use them wisely. It’s important to set boundaries around app usage, avoid obsessive checking, and complement technology with real-world education and planning. Remember, an app is a tool, not a magic solution.

Finance apps come with incredible potential to make managing money easier and more engaging. They offer instant insights, personalized advice, and motivation that were unthinkable a few decades ago. But they also carry the risk of encouraging addictive behaviors, anxiety, and poor decision-making if not used mindfully.…

Before making a significant purchase, take the time to research and compare prices from different sellers or providers. Utilize online tools, price comparison websites, and customer reviews to make informed decisions.

Before making a significant purchase, take the time to research and compare prices from different sellers or providers. Utilize online tools, price comparison websites, and customer reviews to make informed decisions. Make saving a priority by automating your savings. Set up automatic transfers from your checking account to a separate savings account or investment vehicle. Treat your savings like any other bill and allocate a specific portion of your income to savings each month. Automating this process removes the temptation to spend money, making saving a consistent and effortless habit.

Make saving a priority by automating your savings. Set up automatic transfers from your checking account to a separate savings account or investment vehicle. Treat your savings like any other bill and allocate a specific portion of your income to savings each month. Automating this process removes the temptation to spend money, making saving a consistent and effortless habit.

CarsDirect has been one of the most popular places to get a

CarsDirect has been one of the most popular places to get a

Analytics can help you grow your business in several ways. First, it can help you track your website traffic and see where your visitors are coming from. This information is crucial because it can help you adjust your marketing efforts to target the right audience. Second, analytics can help you track your conversion rates and see which products or pages convert the most visitors into customers. This information is crucial because it can help you focus your efforts on the areas yielding the most results. Finally, analytics can help you track your customer service data and see which issues are causing the most problems for your customers.

Analytics can help you grow your business in several ways. First, it can help you track your website traffic and see where your visitors are coming from. This information is crucial because it can help you adjust your marketing efforts to target the right audience. Second, analytics can help you track your conversion rates and see which products or pages convert the most visitors into customers. This information is crucial because it can help you focus your efforts on the areas yielding the most results. Finally, analytics can help you track your customer service data and see which issues are causing the most problems for your customers. Analytics can help you grow your business and find areas of improvement, but it can also help you understand which products or services are most popular with your customers. This information is crucial because it can help you focus your marketing efforts on the right products and ensure that you are stocking the items your customers want. Additionally, this information can help you identify any new products or services that your customers may be interested in so that you can add them to your store.

Analytics can help you grow your business and find areas of improvement, but it can also help you understand which products or services are most popular with your customers. This information is crucial because it can help you focus your marketing efforts on the right products and ensure that you are stocking the items your customers want. Additionally, this information can help you identify any new products or services that your customers may be interested in so that you can add them to your store.

When trying to build your credit up, a Las Vegas Credit Repair Company can be of great help as well. They will work with you and provide suggestions that could improve your score in no time at all. Many people who are not familiar with this process don’t know what they should do to build their credit back up.

When trying to build your credit up, a Las Vegas Credit Repair Company can be of great help as well. They will work with you and provide suggestions that could improve your score in no time at all. Many people who are not familiar with this process don’t know what they should do to build their credit back up. One of the main reasons people hire a credit repair company is because they don’t have time to deal with their creditors. When you hire a professional, they will take care of all your communications. They will also work out payment plans and settlements so that your debt does not continue to increase.

One of the main reasons people hire a credit repair company is because they don’t have time to deal with their creditors. When you hire a professional, they will take care of all your communications. They will also work out payment plans and settlements so that your debt does not continue to increase. If you are in foreclosure or bankruptcy, don’t do this by yourself. It is a highly complex process, and hiring a professional can help make things go much smoother for you. A Las Vegas credit repair company has the experience dealing with these types of cases to ensure they get their clients through them successfully. They will handle all the paperwork and negotiations on your behalf, so you don’t have to.

If you are in foreclosure or bankruptcy, don’t do this by yourself. It is a highly complex process, and hiring a professional can help make things go much smoother for you. A Las Vegas credit repair company has the experience dealing with these types of cases to ensure they get their clients through them successfully. They will handle all the paperwork and negotiations on your behalf, so you don’t have to.

One of the main benefits of having a car insurance plan is that it provides a personal accident cover for a pre-determined amount. In other words, it is crucial to understand that a personal accident cover offers protection against death due to an accident or permanent total disability.

One of the main benefits of having a car insurance plan is that it provides a personal accident cover for a pre-determined amount. In other words, it is crucial to understand that a personal accident cover offers protection against death due to an accident or permanent total disability. It is crucial to understand that you will get an online offer in most insurance policies to benefit from no claim bonus. It is a discount on premium provided by most insurance companies. It acts as a reward for the prudent use of cars. Understanding how it works will help you determine how much you can save on your next car insurance renewal.

It is crucial to understand that you will get an online offer in most insurance policies to benefit from no claim bonus. It is a discount on premium provided by most insurance companies. It acts as a reward for the prudent use of cars. Understanding how it works will help you determine how much you can save on your next car insurance renewal.

The truth is that auto title loans are available to persons who own vehicles and have a good credit history. You are required to submit hard copies of the car’s title to prove that you own the car. After repaying the loan, the lender will revert back the documents to you. Thus, you will continue using your car as you repay the loan.

The truth is that auto title loans are available to persons who own vehicles and have a good credit history. You are required to submit hard copies of the car’s title to prove that you own the car. After repaying the loan, the lender will revert back the documents to you. Thus, you will continue using your car as you repay the loan.

your banks. There are banks and financial institutions with loans tailored for such. Find out if you qualify for one and apply. Saving is another option if you want to raise enough money for your home renovations. You can start doing this months before the planned improvement date. Proper budgeting is vital because it will give you a rough idea of the amount you may need for your home improvement project. Here is how you can budget for such.

your banks. There are banks and financial institutions with loans tailored for such. Find out if you qualify for one and apply. Saving is another option if you want to raise enough money for your home renovations. You can start doing this months before the planned improvement date. Proper budgeting is vital because it will give you a rough idea of the amount you may need for your home improvement project. Here is how you can budget for such. also guide you when drafting your home renovation budget. If you depend on yourself, then you will list down materials that match what you have in your account. You can have a bigger budget if you have more funding sources.…

also guide you when drafting your home renovation budget. If you depend on yourself, then you will list down materials that match what you have in your account. You can have a bigger budget if you have more funding sources.…

the conventional type. You can also access them with a poor credit score because of the different factors they will consider to tell if you are eligible. Choosing the right moneylender is essential if you want to have a smooth time during the borrowing and repayment process. Here is what to consider when looking for a moneylender.

the conventional type. You can also access them with a poor credit score because of the different factors they will consider to tell if you are eligible. Choosing the right moneylender is essential if you want to have a smooth time during the borrowing and repayment process. Here is what to consider when looking for a moneylender. had the chance to borrow from these platforms will help you know the best moneylender. There are different platforms where you will come across comments from different people who have had the chance of borrowing from various lenders. This will help you understand how most of them work and also the reputation of specific lenders out there.…

had the chance to borrow from these platforms will help you know the best moneylender. There are different platforms where you will come across comments from different people who have had the chance of borrowing from various lenders. This will help you understand how most of them work and also the reputation of specific lenders out there.…

The internet makes it quite easy to find and review lenders. Thus, it is vital for consumers to search for diligently their options before committing to a given lender. The right way of doing this is by using various comparison sites. Different web-based platforms can allow prospective borrowers to look for lenders that are based on their needs. When you use these tools, people can easily find lenders who do not perform background checks.

The internet makes it quite easy to find and review lenders. Thus, it is vital for consumers to search for diligently their options before committing to a given lender. The right way of doing this is by using various comparison sites. Different web-based platforms can allow prospective borrowers to look for lenders that are based on their needs. When you use these tools, people can easily find lenders who do not perform background checks. Usually, lenders who offer quick loans have few basic requirements that people ought to meet to get funding. For instance, you need to show that you are a legal adult and capable of entering agreements that can bind you legally. You need to show proof of income and information pertaining to your banking accounts. Also, you may need to be enrolled in deposit programs. Usually, your paycheck will be used as collateral.

Usually, lenders who offer quick loans have few basic requirements that people ought to meet to get funding. For instance, you need to show that you are a legal adult and capable of entering agreements that can bind you legally. You need to show proof of income and information pertaining to your banking accounts. Also, you may need to be enrolled in deposit programs. Usually, your paycheck will be used as collateral.

If you have lost a social security card, you need to replace it as soon as possible. You do not want to spend a lot of time without it in case you don’t have to. That is because this card is essential to your livelihood.

If you have lost a social security card, you need to replace it as soon as possible. You do not want to spend a lot of time without it in case you don’t have to. That is because this card is essential to your livelihood. Applying one by yourself is a lot of fuss. You have to be waiting in lines, reading through confusing instructions and documents, getting the formatting accurate, as well as submitting the correct documentation. They can help you with what you need and get it done in a matter of minutes.…

Applying one by yourself is a lot of fuss. You have to be waiting in lines, reading through confusing instructions and documents, getting the formatting accurate, as well as submitting the correct documentation. They can help you with what you need and get it done in a matter of minutes.…

There are some of the payroll systems that tend to be complicated. Most of your employees may find it challenging operating some of the tools involved. But once you have hired a qualified payroll company, they will be in a good position of running most of these devices.

There are some of the payroll systems that tend to be complicated. Most of your employees may find it challenging operating some of the tools involved. But once you have hired a qualified payroll company, they will be in a good position of running most of these devices. It is clear that many companies out there have existing business investments for various benefits. That is why when you are choosing the right company you need to check on the data integration capabilities. Some of the benefits you are recommended to get are: reduced paperwork, point-in-time reporting and eliminated duplicate data entry.

It is clear that many companies out there have existing business investments for various benefits. That is why when you are choosing the right company you need to check on the data integration capabilities. Some of the benefits you are recommended to get are: reduced paperwork, point-in-time reporting and eliminated duplicate data entry.

There are many hospitals all across Australia, and emergencies will not wait until you are near to the hospital with your insurance will cover. Often, people get into a particular misfortune, and it got worse when their insurance company cannot pay for the expenses. For this reason, it is essential for you to choose a health insurance program that includes as many types of a hospital when possible. You should also check on the kinds of treatment and doctors that your insurance will pay. This way, wherever and whenever it happens, no matter what kinds of remedial actions that you need to have, you never have to worry about it.

There are many hospitals all across Australia, and emergencies will not wait until you are near to the hospital with your insurance will cover. Often, people get into a particular misfortune, and it got worse when their insurance company cannot pay for the expenses. For this reason, it is essential for you to choose a health insurance program that includes as many types of a hospital when possible. You should also check on the kinds of treatment and doctors that your insurance will pay. This way, wherever and whenever it happens, no matter what kinds of remedial actions that you need to have, you never have to worry about it. Every program will have their benefits so they can compete against each other and attract customers. Pay attention to those details and write in down somewhere if you must, later you can compare with other programs that you are interested in and make the best decision. Just remember not to get lost in the number of benefits, you also need to see whether each thing that you will get is valuable or not.…

Every program will have their benefits so they can compete against each other and attract customers. Pay attention to those details and write in down somewhere if you must, later you can compare with other programs that you are interested in and make the best decision. Just remember not to get lost in the number of benefits, you also need to see whether each thing that you will get is valuable or not.…

In case of an accident

In case of an accident Paying medical bills

Paying medical bills

Another exciting reward associated with payday loans is that the lender does not rely on your credit score to determine whether to award or decline your application. However, your credit rating might affect the interest rates and not the amount you qualify to get. This implies that a good credit score would mean reduced interest rates. You can also use payday loans to improve your credit score.

Another exciting reward associated with payday loans is that the lender does not rely on your credit score to determine whether to award or decline your application. However, your credit rating might affect the interest rates and not the amount you qualify to get. This implies that a good credit score would mean reduced interest rates. You can also use payday loans to improve your credit score.

…

…

Vehicles must operate when they have a valid insurance cover and licensed drivers. Apart from these two crucial documents, they also need inspection certificates and other documentation depending on the state policies.

Vehicles must operate when they have a valid insurance cover and licensed drivers. Apart from these two crucial documents, they also need inspection certificates and other documentation depending on the state policies. Fleet owners are in business and the more cost is reduced without compromising the service, the better for them. It is the enormous task of the fleet management company to come up with a way of reducing cost. Saving on fuel is the everyday cost reduction every manager want to an emphasis on. Therefore, the drivers have to follow designated routes, embrace best driving habits and report any mechanical problem with the vehicle.

Fleet owners are in business and the more cost is reduced without compromising the service, the better for them. It is the enormous task of the fleet management company to come up with a way of reducing cost. Saving on fuel is the everyday cost reduction every manager want to an emphasis on. Therefore, the drivers have to follow designated routes, embrace best driving habits and report any mechanical problem with the vehicle.

Borrow or buy used books

Borrow or buy used books Look for a part-time job

Look for a part-time job

Argument of assets

Argument of assets